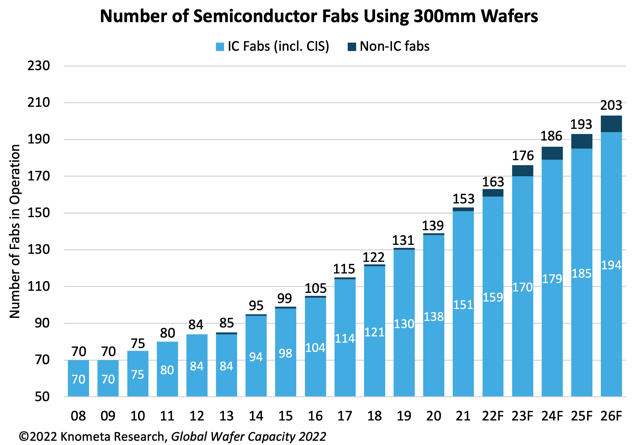

Industry's aggressive fab expansion plans do not necessarily mean a capacity glut is looming

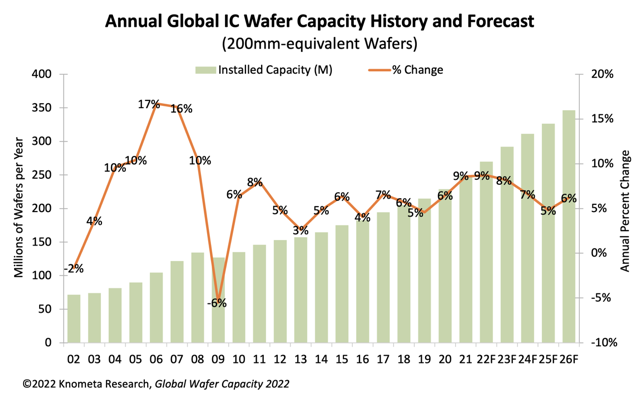

With fab construction activity at its highest level in many years, it is not surprising that there has been talk of a market crash coming from too much capacity being added. The new Global Wafer Capacity 2022 report makes the case that, while fab expansion plans are certainly aggressive and could lead to some downward pricing pressure in 2024, a significant market downturn caused by too many fabs sitting with idle capacity is not expected.