Industry's aggressive fab expansion plans do not necessarily mean a capacity glut is looming

With fab construction activity at its highest level in many years, it is not surprising that there has been talk of a market crash coming from too much capacity being added. The new Global Wafer Capacity 2022 report makes the case that, while fab expansion plans are certainly aggressive and could lead to some downward pricing pressure in 2024, a significant market downturn caused by too many fabs sitting with idle capacity is not expected.

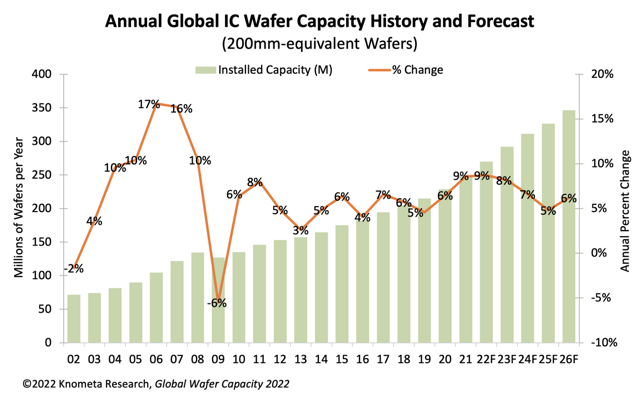

In 2021, IC manufacturers responded to widespread shortages by increasing capacity 8.6%. This was the highest rate since 8.0% in 2011 or 10.4% in 2008. For 2022, an 8.7% expansion of capacity is expected, followed by 8.2% growth in 2023.

In 2021, IC manufacturers responded to widespread shortages by increasing capacity 8.6%. This was the highest rate since 8.0% in 2011 or 10.4% in 2008. For 2022, an 8.7% expansion of capacity is expected, followed by 8.2% growth in 2023.

Capital spending for fabs and equipment, expressed as a percent of semiconductor revenue, was at 25% in 2021, the highest rate since 2001 when the ratio was 26%. In the past, very high spending-to-sales ratios usually indicated too much capacity was being added and a market correction was coming soon. In 2001, capacity utilization rates tumbled sharply from 2000 when chip demand crashed. However, in contrast to 2001, unit shipments in 2021 were very strong, resulting in a high overall utilization rate of nearly 94%.

The capex-to-sales ratio is forecast to remain high in 2022 as chip manufactures continue adding wafer capacity to address on-going shortages. Because of the depth and length of the shortages, there has been a revival in the global interest of building fabs. Governments in countries that have spent the past decade de-emphasizing the business of making chips have renewed interests in providing incentives for companies to build fabs in their countries.

Naturally, the current elevated status of fab construction activity and flood of new fab construction plans raise some concern that too much capacity will be added in the next couple years, leading potentially to downward pricing pressure from supply exceeding demand. However, Knometa Research partner IC Insights predicts good growth for IC unit demand in 2022 and 2023, followed by a lower but still positive increase in 2024.

A 5% decline in the IC average selling price in 2024 is forecast by IC Insights and a falling ASP is a sign of supply outstripping demand. However, unit shipments that year are still expected to increase 4%, resulting in a market contraction of just 2%. Furthermore, IC Insights is projecting a return to growth in 2025 and 2026.

Based on continuing healthy demand for integrated circuits and the fact that manufacturers are still working to address the vast shortage situations, the industry’s capacity current expansion plans do not seem overly excessive.

The Global Wafer Capacity 2022 report is available for purchase here.

The capex-to-sales ratio is forecast to remain high in 2022 as chip manufactures continue adding wafer capacity to address on-going shortages. Because of the depth and length of the shortages, there has been a revival in the global interest of building fabs. Governments in countries that have spent the past decade de-emphasizing the business of making chips have renewed interests in providing incentives for companies to build fabs in their countries.

Naturally, the current elevated status of fab construction activity and flood of new fab construction plans raise some concern that too much capacity will be added in the next couple years, leading potentially to downward pricing pressure from supply exceeding demand. However, Knometa Research partner IC Insights predicts good growth for IC unit demand in 2022 and 2023, followed by a lower but still positive increase in 2024.

A 5% decline in the IC average selling price in 2024 is forecast by IC Insights and a falling ASP is a sign of supply outstripping demand. However, unit shipments that year are still expected to increase 4%, resulting in a market contraction of just 2%. Furthermore, IC Insights is projecting a return to growth in 2025 and 2026.

Based on continuing healthy demand for integrated circuits and the fact that manufacturers are still working to address the vast shortage situations, the industry’s capacity current expansion plans do not seem overly excessive.

The Global Wafer Capacity 2022 report is available for purchase here.