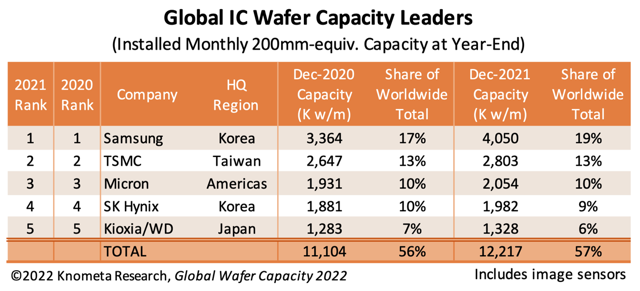

Top Five Leaders Continue Expanding Share of Global IC Fab Capacity

At the end of 2021, 57% of the industry’s total monthly wafer capacity was owned by the top five companies. One year earlier the share was 56% and back in 2018 it was 53%. A decade ago, the share held by the top five was about 40%. The industry continues to get more top heavy regarding the composition of companies fabricating ICs. This analysis comes from Knometa’s recently released Global Wafer Capacity 2022 report.

Combined, the top five companies had the capacity to process 12.2 million wafers per month at the end of the year, or 10% more than the year before. That growth rate was one percentage point higher than for the industry’s total capacity.

Combined, the top five companies had the capacity to process 12.2 million wafers per month at the end of the year, or 10% more than the year before. That growth rate was one percentage point higher than for the industry’s total capacity.

Samsung — In 2021, the company widened its lead as the industry’s biggest source of fab capacity. At the end of the year, Samsung held 19% of total global IC wafer capacity and 44% more capacity than the second largest company TSMC. Samsung boosted its capital spending 45% in 2020 and that translated into a sizable increase in available capacity in 2021. Most of the money was spent on the construction of multiple 300mm fab lines at its site in Pyeongtaek.

Samsung said at its 2021 Investors Forum that, when compared to its 2017 capacity level, the company’s fab expansion plans will result in a tripling of capacity by 2026. Those plans will include a new $17 billion fab to be built in Taylor, Texas, the construction of which is due to start in 2022. The Taylor fab will support the company’s strong push to expand foundry services for leading edge processes.

TSMC — The company’s capacity growth in 2021 was relatively mild, but strong demand for its services spurred a significant increase in capital spending during the year that will result in a higher capacity growth rate in 2022. TSMC plans to remain aggressive with its spending in 2022 and 2023 as well.

Most of TSMC’s recent fab construction activity has been centered at its Fab 18 site in Tainan. The company recently started adding capacity again at its Fab 12 site in Hsinchu. The last fab phase to open at the site was Phase 7 in 2017. Fab 12 Phase 8 is under construction and scheduled to begin operations in 2022.

TSMC has also experienced strong demand for mature technologies, especially for 28nm CMOS. To meet this demand, the company is expanding its Fab 16 facility in China to double the capacity there by mid-2023.

Fabs at three entirely new or “greenfield” sites around the globe are or soon will be under construction. The first phase of a large fab site (Fab 21) in Phoenix, Arizona, is already under construction and will begin processing 300mm wafers in 2024. The $12 billion Fab 21 Phase 1 plant will be used to make chips with 5nm technology. In Kumamoto, Japan, TSMC partnered with Sony to build a $7 billion 300mm fab that will also open in 2024. In November 2021, the company announced the selection of Kaohsiung as the site for another fab complex in Taiwan.

Micron — The company’s capital spending the past couple years has been focused more on upgrading existing capacity for more advanced processing capabilities than on increasing capacity. Nevertheless, the company made some additional capacity available in 2021 in the form of phase 4 at Fab 15, phase 2 at Fab 16, and an expansion of its legacy products fab in Virginia.

During Micron’s fiscal Q1 2022 earnings call it was reported that for both DRAM and NAND the company plans to achieve bit supply growth with node transitions through the middle of the decade. In other words, Micron’s capital spending is focused on new technologies and equipment that will enable it to increase chip production volumes via die shrinks for DRAM and continued 3D scaling for 3D NAND. As a result, the company will not bring online any major fab expansions in the next couple years. The next big fab project for Micron, announced in October 2021, is the construction of a new 300mm fab at its site in Hiroshima. This fab will open for production in 2024.

SK Hynix — After boosting its capital spending substantially in 2018 for the construction of new fabs in Korea and China, SK Hynix scaled back expenditures in 2019 and 2020. Fab M15 in Cheongju and Fab C2F in Wuxi both began operations in 2019 but ramping of capacity and production at the fabs has been gradual. The company lifted its capex significantly in 2021 and that should translate to a larger increase in capacity for 2022.

Construction of the company’s newest fab, M16 in Icheon was finished in early 2021 and the company began operations in the fourth quarter of the year.

In December 2021, SK Hynix took ownership of Intel’s Fab 68 facility in Dalian, China. However, the fab is still used by Intel to fabricate 3D NAND chips, so its capacity at the end of 2021 was not included as part of SK Hynix. The acquisition of Intel’s NAND and SSD businesses by SK Hynix is a multiple-stage transaction over several years and stipulates that Intel can use the fab for wafer fabrication until March 2025, when SK Hynix will complete the purchase.

Kioxia/Western Digital — Capacity jointly owned by Kioxia and Western Digital increased at the lowest rate among the top five companies in 2021. The partners are increasing 3D NAND die production volumes more by 3D scaling advancements than by increasing capacity. Western Digital’s President of Technology & Strategy, Srinivasan Sivaram reported in December 2021 that the company’s approach to production capacity is currently about “95% conversion, 5% new wafers,” meaning that nearly all its product supply needs are being met by converting to new technologies. For 3D NAND, that means increasing NAND layer counts on the chips to achieve a greater amount of memory storage per unit area. Mr. Sivaram has said Western Digital has a clear roadmap to more than 300 layers in the next four to five years.

Kioxia and Western Digital have a new fab at their site in Yokkaichi scheduled to begin operations in early 2023. Like other fabs at the site, the Y7 fab will be built in two phases. In April 2022, the partners started building a second fab at their site in Kitakami. The existing K1 fab started production in 2020 and the new K2 fab is expected to start up in 2024.

The Global Wafer Capacity 2022 report is available for purchase here.

Samsung said at its 2021 Investors Forum that, when compared to its 2017 capacity level, the company’s fab expansion plans will result in a tripling of capacity by 2026. Those plans will include a new $17 billion fab to be built in Taylor, Texas, the construction of which is due to start in 2022. The Taylor fab will support the company’s strong push to expand foundry services for leading edge processes.

TSMC — The company’s capacity growth in 2021 was relatively mild, but strong demand for its services spurred a significant increase in capital spending during the year that will result in a higher capacity growth rate in 2022. TSMC plans to remain aggressive with its spending in 2022 and 2023 as well.

Most of TSMC’s recent fab construction activity has been centered at its Fab 18 site in Tainan. The company recently started adding capacity again at its Fab 12 site in Hsinchu. The last fab phase to open at the site was Phase 7 in 2017. Fab 12 Phase 8 is under construction and scheduled to begin operations in 2022.

TSMC has also experienced strong demand for mature technologies, especially for 28nm CMOS. To meet this demand, the company is expanding its Fab 16 facility in China to double the capacity there by mid-2023.

Fabs at three entirely new or “greenfield” sites around the globe are or soon will be under construction. The first phase of a large fab site (Fab 21) in Phoenix, Arizona, is already under construction and will begin processing 300mm wafers in 2024. The $12 billion Fab 21 Phase 1 plant will be used to make chips with 5nm technology. In Kumamoto, Japan, TSMC partnered with Sony to build a $7 billion 300mm fab that will also open in 2024. In November 2021, the company announced the selection of Kaohsiung as the site for another fab complex in Taiwan.

Micron — The company’s capital spending the past couple years has been focused more on upgrading existing capacity for more advanced processing capabilities than on increasing capacity. Nevertheless, the company made some additional capacity available in 2021 in the form of phase 4 at Fab 15, phase 2 at Fab 16, and an expansion of its legacy products fab in Virginia.

During Micron’s fiscal Q1 2022 earnings call it was reported that for both DRAM and NAND the company plans to achieve bit supply growth with node transitions through the middle of the decade. In other words, Micron’s capital spending is focused on new technologies and equipment that will enable it to increase chip production volumes via die shrinks for DRAM and continued 3D scaling for 3D NAND. As a result, the company will not bring online any major fab expansions in the next couple years. The next big fab project for Micron, announced in October 2021, is the construction of a new 300mm fab at its site in Hiroshima. This fab will open for production in 2024.

SK Hynix — After boosting its capital spending substantially in 2018 for the construction of new fabs in Korea and China, SK Hynix scaled back expenditures in 2019 and 2020. Fab M15 in Cheongju and Fab C2F in Wuxi both began operations in 2019 but ramping of capacity and production at the fabs has been gradual. The company lifted its capex significantly in 2021 and that should translate to a larger increase in capacity for 2022.

Construction of the company’s newest fab, M16 in Icheon was finished in early 2021 and the company began operations in the fourth quarter of the year.

In December 2021, SK Hynix took ownership of Intel’s Fab 68 facility in Dalian, China. However, the fab is still used by Intel to fabricate 3D NAND chips, so its capacity at the end of 2021 was not included as part of SK Hynix. The acquisition of Intel’s NAND and SSD businesses by SK Hynix is a multiple-stage transaction over several years and stipulates that Intel can use the fab for wafer fabrication until March 2025, when SK Hynix will complete the purchase.

Kioxia/Western Digital — Capacity jointly owned by Kioxia and Western Digital increased at the lowest rate among the top five companies in 2021. The partners are increasing 3D NAND die production volumes more by 3D scaling advancements than by increasing capacity. Western Digital’s President of Technology & Strategy, Srinivasan Sivaram reported in December 2021 that the company’s approach to production capacity is currently about “95% conversion, 5% new wafers,” meaning that nearly all its product supply needs are being met by converting to new technologies. For 3D NAND, that means increasing NAND layer counts on the chips to achieve a greater amount of memory storage per unit area. Mr. Sivaram has said Western Digital has a clear roadmap to more than 300 layers in the next four to five years.

Kioxia and Western Digital have a new fab at their site in Yokkaichi scheduled to begin operations in early 2023. Like other fabs at the site, the Y7 fab will be built in two phases. In April 2022, the partners started building a second fab at their site in Kitakami. The existing K1 fab started production in 2020 and the new K2 fab is expected to start up in 2024.

The Global Wafer Capacity 2022 report is available for purchase here.