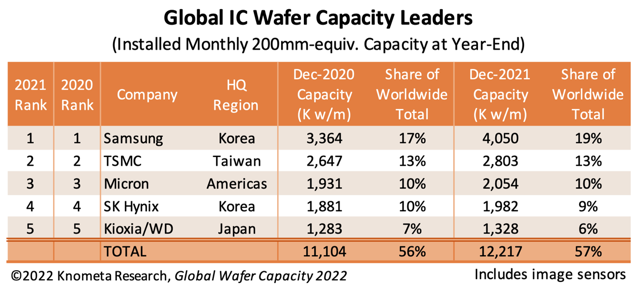

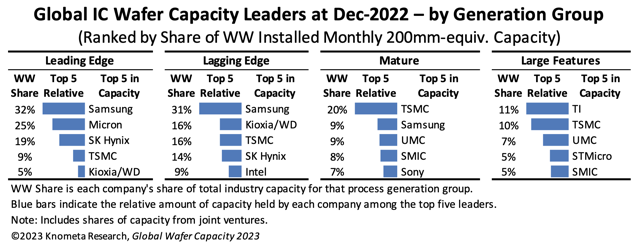

Samsung, Micron, and SK Hynix Account for Three-Fourths of Leading-Edge Wafer Capacity

In analyzing the IC industry's installed wafer capacity for its new Global Wafer Capacity 2023 report, Knometa Research compiled data to identify the top companies in the segments of leading-edge, lagging-edge, mature, and large-feature technologies. At the end of 2022, Samsung, Micron, and SK Hynix accounted for 76% of leading-edge capacity, with the vast majority of it for advanced DRAM and 3D NAND production.